Hey Insiders,

Have you ever stared at an offer letter, wondering how much of that CTC will actually end up in your bank account?

Last week, I was talking to a friend who graduated from IIM-A a couple of years ago and he was sharing with me about his experiences about his first job after becoming an MBA graduate. Crazy part? He had bagged an annual package of ₹1 core. It was one of the highest packages among his batchmates. Not just that, it was one of the highest packages offered across the country. He was extremely elated at the time, and of course for the right reasons. It was going to be his first job after MBA and bagging such a high package is a hefty cool achievement.

But the crazier part was his salary structure. He shared with me his offer letter and it was surprising how much of that CTC would actually end up being in his bank account.

So, I thought why not show it to you guys as well? While I can’t name him or the company or show you the exact offer letter, I’ll break down the CTC in its entirety and try to explain you all the layers in detail.

Firstly, what’s CTC?

CTC or Cost to Company is the total amount an employer would spend on an employee in a year. It includes several components, some of which are direct benefits (like basic salary, house rent allowance), while others are indirect (like employer contributions to Provident Fund, Medical insurance, etc) or even non-cash benefits (like free meals, cab service).

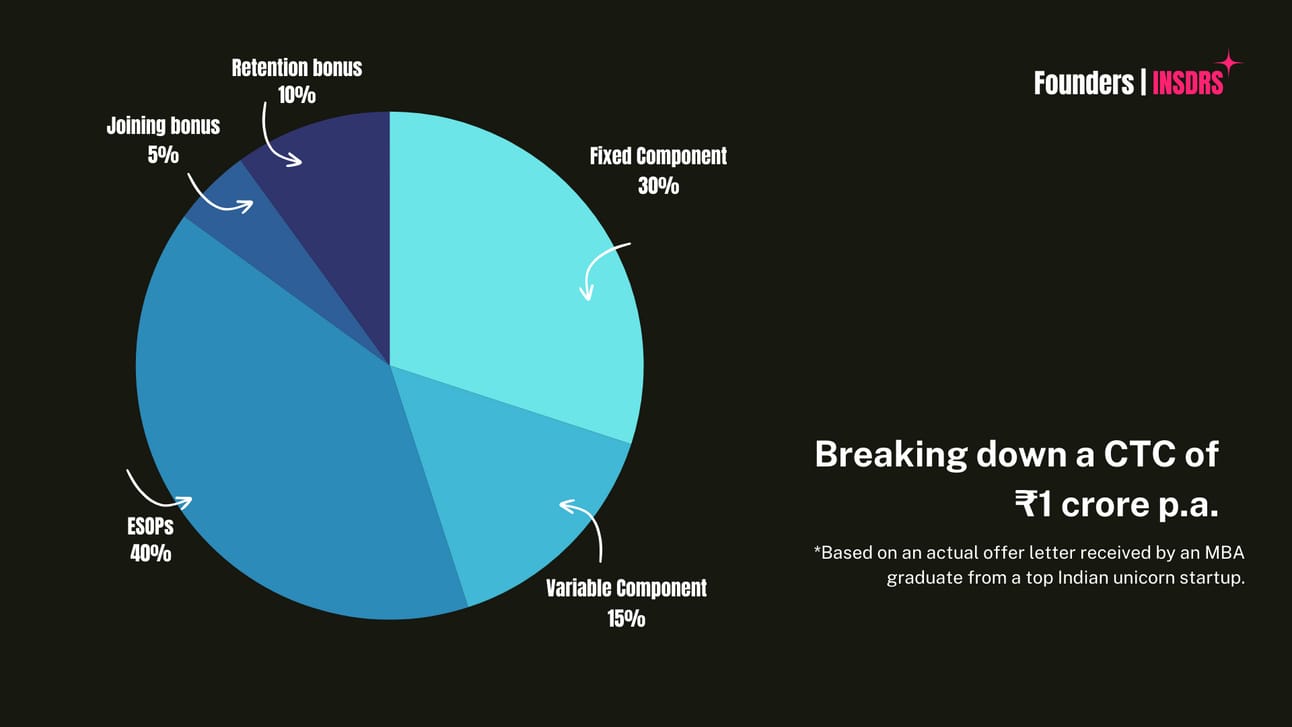

Breaking Down ₹1 Crore CTC

To understand what this means on a monthly basis, and more importantly, what you actually take home, let's break down a typical ₹48 LPA package:

Fixed Salary: ₹30 lakhs

Fixed Salary is the guaranteed part of your compensation.

Variable Pay: ₹15 lakhs

Variable Pay typically depends on employee’s and company’s performance and policies.

Employee Stock Option Plan (ESOPs): ₹40 lakhs, vested over 4 years

ESOPs are a form of long-term incentive to keep you invested in the company’s success.

Joining Bonus: ₹5 lakhs

Joining Bonus is a one-time payment

Retention Bonus: ₹10 lakhs (paid after 3 years of employment)

Retention Bonus is paid out to retain talent in the company.

Calculating the In-Hand Salary

To calculate the monthly in-hand salary, we need to consider only the annual components that you receive in your bank account monthly. ESOPs are not liquid cash until vested and sold, and bonuses are typically one-time payments.

Here’s the monthly breakdown:

Fixed Salary: ₹30 lakhs per year translates to ₹2,50,000 per month.

Variable Pay: If fully paid (assuming best-case scenario), ₹15 lakhs per year is about ₹1,25,000 per month. However, this is often subject to performance and may not be fully guaranteed.

Monthly Take-Home Before Taxes: ₹2,50,000 (Fixed) + ₹1,25,000 (Variable if fully paid) = ₹3,75,000

Tax Deductions

To calculate the net in-hand salary, tax calculations based on the current tax slabs must be applied. Let’s assume you fall into the highest tax bracket (30% above ₹10 lakhs income), considering your income level. We will apply a simplified model for tax calculation without deductions or exemptions for the sake of clarity:

Income Tax: The tax on ₹45 lakh (Fixed + Variable, if fully paid) could be approximately ₹10.58 lakhs annually (this is calculated as per new regime).

Monthly Tax: About ₹88,167

Net Monthly In-Hand Salary: ₹3,75,000 - ₹88,167 = ₹2,86,833 approximately

(Again, this is a basic approximation. Actual in-hand salary could be different based on exact tax deductions, tax-saving investments, and actual payout of variable components)

By the way, if you’re someone (like me) who is a little skeptical about what AI could be replacing next, or just someone who is curious (also like me) about the wonders of AI or growth strategies, I highly recommend you give this newsletter a read:

Learn how to make AI work for you

AI won’t take your job, but a person using AI might. That’s why 1,000,000+ professionals read The Rundown AI – the free newsletter that keeps you updated on the latest AI news and teaches you how to use it in just 5 minutes a day.

Additional Considerations

Joining Bonus and Retention Bonus are not included in monthly calculations as they are one-time payments. These would increase your cash inflow in the specific months they are paid.

ESOPs provide additional value but are contingent on the company's stock performance and are not liquid until vested and sold.

Conclusion

While a ₹1 crore package sounds extremely ricjh, the actual monthly take-home salary after taxes and excluding non-regular components like ESOPs and bonuses stands around ₹3 lakh. It’s crucial for professionals to understand their salary breakdowns to plan their finances effectively.

Share this with a friend, colleague or your boss (I dare you! 😈)

See you in the next one, bye! 👋🏻