Amazon's ad business is booming, pulling in almost $40 billion last year—a figure that not only surpasses its Prime service but also the global newspaper market and perhaps even AWS in terms of profitability.

For people who enjoy browsing through major companies' financial details, Amazon's recent financials offer an interesting insight. A notable increase in the "other" revenue section has been observed over the past few years. By 2021, Amazon provided more clarity on this segment, revealing a staggering $38 billion from advertising alone in the following year, overtaking any traditional media company and the (now smaller) global newspaper industry in revenue.

Ads revenue come with excellent profitability too!

Looking at the numbers, Amazon's ad division is a goldmine. While the $38 billion from ads is a small slice of Amazon's overall $502 billion revenue in 2022, the sector's operating margins—estimated to be over 50%—suggest an operating profit on par with AWS, ranging between $20-25 billion. This is achieved with far less capital expenditure, highlighting an efficient profit model, especially when compared to Amazon's total operating income of $12 billion for that year.

Comparing Ads revenue with Prime subscriptions revenue

Amazon's advertising made $38 billion, surprisingly more than what they earn from Prime memberships. Calculating Prime's real profit is tricky because it's not just about membership fees; it also makes people buy more. Similarly, figuring out the exact profit from Amazon's ads is not straightforward, similar to why Apple doesn't break down how much money the App Store makes.

The big question is what these ads do for Amazon. Some feel that ads make shopping on Amazon less enjoyable because they're everywhere. It raises a debate: are these really ads or something else, like paying for a better spot in search results? This question also applies to Google's search ads. What exactly counts as an ad, and does it matter?

Looking at it another way, Amazon's ad strategy might be about seeing which brands can afford to pay more for visibility. It's like an auction where brands bid for the best spots, letting them decide what's worth their money. This method suits Amazon's goal to be efficient, avoiding the hassle of negotiating with each brand individually.

Amazon's Marketplace is a prime example of scaling to the extreme. By opening its APIs, Amazon allows external sellers to do the work of sourcing and listing products, essentially outsourcing this task without hiring teams. This turns product placement into a tool for price discrimination and a way to sift through the myriad of products on the platform. With hundreds of millions of SKUs available, how does Amazon highlight what customers might want? One method is to observe which products vendors are willing to pay to promote. In a way, Amazon Marketplace isn't just a platform connecting consumers and vendors but also a competitive market where Amazon itself acts as the buyer, and vendors bid for prominence.

New age advertisers - The rise of retail media

The explosion of "retail media" is a testament to the realisation that high-traffic websites or apps can serve as lucrative advertising spaces, even for entities not traditionally seen as media companies. This shift is driven by access to valuable first-party data, including customer intent and buying patterns, especially as the industry moves away from third-party cookies and other data sources due to privacy concerns. This environment has turned retail platforms like Walmart, which reported $2.7 billion in ad revenue last year, and Uber, with a $500 million ad revenue run rate, into major players in the advertising space. For context, the New York Times' ad revenue was $523 million, highlighting the scale of retail media. GroupM estimated that this sector accounted for 10% of US ad revenue last year.

This brings us to a broader question about the nature of advertising and marketing. The distinction between the two is becoming increasingly blurred. A few years ago, the idea that "rent is the new customer acquisition cost (CAC)" gained traction, suggesting that all expenses related to reaching and serving customers, including retail rents and online visibility fees, should be considered part of the total addressable market (TAM) for advertising. This redefinition not only impacts Amazon but also significantly affects Google. The debate extends to whether the fees for prime placement in search results should be classified as advertising, marketing, or just a part of operating margins.

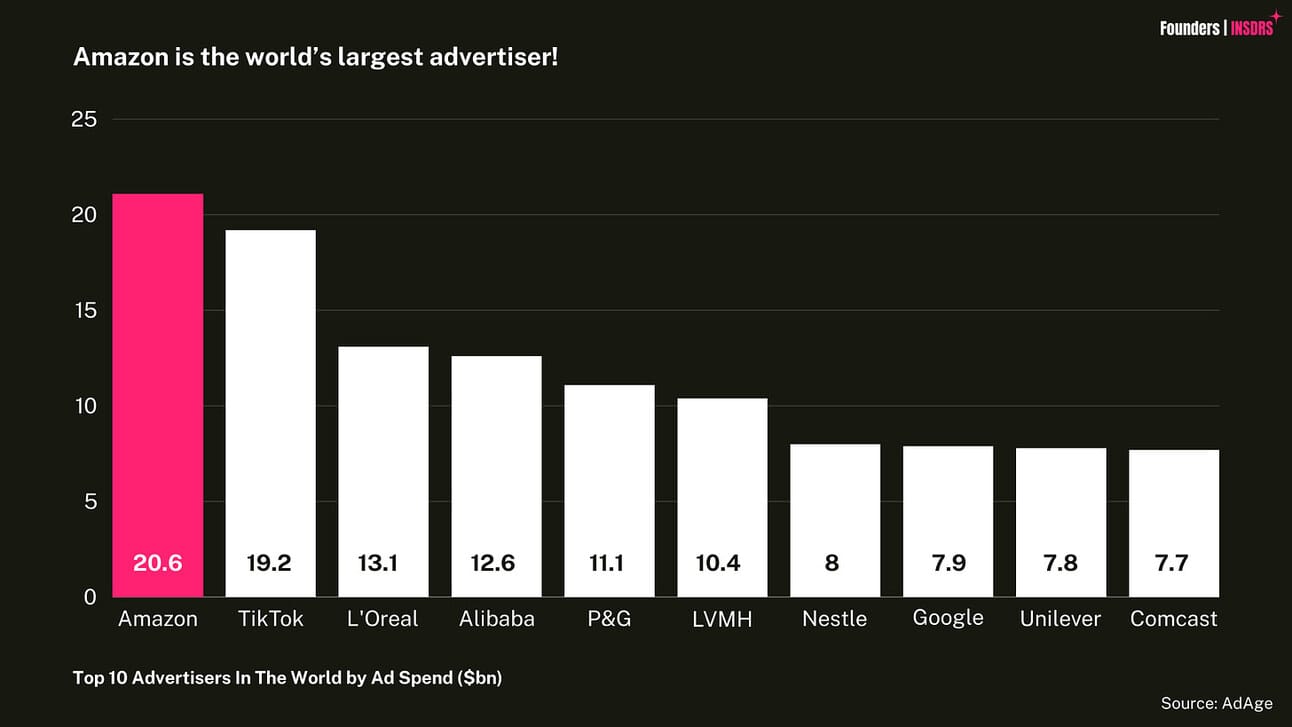

In this evolving landscape, every expenditure aimed at attracting consumers—from TV ads to search placement fees, retail rents, or even the terms of sale—becomes a part of the strategic mix. The question of whether Amazon Ads are considered advertising, marketing, slotting fees, trade dollars, discounts, or price discrimination essentially receives a resounding "Yes." Similarly, Amazon, now arguably the world's largest advertiser, embodies this shift, blurring the lines between various forms of customer outreach and redefining the essence of marketing and advertising in the digital age.